Best Alternatives to PayPal for Nigerian Entrepreneurs

PayPal has long been a popular choice for online transactions, for Nigerians including entrepreneurs. Nevertheless, due to numerous restrictions and difficulties that Nigerians encounter when using PayPal, It is necessary to look into alternative payment platforms that might meet the needs of Nigerian business owners.

The topic acknowledges the popularity of PayPal among Nigerians but highlights the limitations faced by Nigerian users especially entrepreneurs.

It also suggests exploring alternative payment platforms that can cater to the needs of Nigerian entrepreneurs.

The analysis also focuses on the advantages, features, and suitability of these alternatives for commercial transactions in Nigeria.

As a result of this, we will analyze the 15 best alternatives to PayPal for Nigerian entrepreneurs in this article, emphasizing their advantages, features, and suitability for commercial transactions.

What is Paypal?

PayPal is an online payment system that makes it simple to transfer and receive money while making secure online purchases. Once your bank account, credit card, or debit card is linked to your PayPal account, you can use PayPal to make online purchases from participating shops. Since PayPal serves as a middleman between your bank and merchants, your payment information is secure with them.

PayPal also enables you to receive payments from others and send money securely to loved ones.

ALSO, READ Best And Trending Online Digital Microfinance Banks in Nigeria 2023

However, PayPal has several drawbacks. For instance, there is a fee of close to 10% when money is received through PayPal into a business account. Furthermore, Paypal has the authority to suspend your account in response to any grievance. Additionally, it could take a while for your identification to be verified before you can transfer money to the bank of your choice. For these reasons and others, many Nigerians continue to explore alternatives.

15 Best Alternatives To PayPal For Nigerian Entrepreneurs in 2024

As an alternative to PayPal, other online transaction platforms offer a variety of payment options for Nigerian business owners, enabling them to carry out transactions efficiently and safely.

To select the alternative payment platform that best meets your company’s objectives, it is crucial to investigate and contrast some of its features concerning transaction costs, integration possibilities, and other factors. Some alternatives to the Paypal online transaction platform are elucidated as follows:

15 Best Alternatives To PayPal For Nigerian Entrepreneurs In 2023

- Payoneer

- Paystack

- Skrill

- Flutterwave

- Stripe

- Interswitch WebPay

- Remitly

- BOSS Revolution

- VoguePay

- Remita

- Paga

- Quickteller

- eTranzact

- Opay

- CashEnvoy

1. Payoneer

Payoneer is a global financial services company that provides online money transfer and payment solutions. It offers individuals and businesses a secure and convenient way to send, receive, and manage funds globally. Payoneer’s services are particularly beneficial for freelancers, online sellers, digital marketers, and international businesses.

One of the main features of Payoneer is its ability to facilitate cross-border payments. Users can receive payments from clients and marketplaces worldwide, including popular platforms like Amazon, Upwork, and Airbnb. Payoneer provides users with local receiving accounts in different currencies, allowing them to receive payments as if they had a local bank account in that country.

Payoneer also offers a prepaid Mastercard, which can be linked to the user’s account. The card allows users to withdraw funds from ATMs, make purchases online and offline, and use the card for day-to-day transactions.

Furthermore, Payoneer’s platform provides features like mass payouts, enabling businesses to pay their suppliers, partners, and freelancers in a streamlined manner. It offers flexible withdrawal options, including bank transfers, local currency transfers, and even payments to other Payoneer users.

Overall, Payoneer simplifies global payments and enables businesses and individuals to overcome the barriers of traditional banking systems. Its services offer convenience, efficiency, and flexibility for cross-border transactions, making it a popular choice for freelancers, e-commerce sellers, and international businesses looking for seamless global payment

Pros Of Payoneer

- Global reach and the ability to receive payments from various countries is possible through Payoneer.

- It provides convenient and secure online money transfer and payment solutions.

- Local receiving accounts in different currencies for easy payment collection.

- Prepaid Mastercard for easy access to funds and day-to-day transactions.

Cons Of Payoneer

- Some fees are associated with particular transactions and services.

- Limited availability in certain countries and regions.

- Reliance on the Payoneer platform and network for payments and withdrawals.

- Customer support may vary in responsiveness and effectiveness.

2. Paystack

Paystack is the second on our list of the top ten PayPal alternatives for Nigerian business owners in 2023. Nigerian payment gateway Paystack enables a range of payment methods, including card payments and direct bank transfers, and offers seamless connections with regional banks. It is a great option for Nigerian business owners since it offers configurable payment pages, fraud protection, and simple interaction with e-commerce platforms.

Paystack develops technologies to assist Africa’s top companies in expanding, from fresh start-ups to industry giants introducing novel business models. We make it simple for businesses to accept safe payments through a variety of regional and international payment channels, and we then give you access to technologies that will help you keep your current clients and win new ones.

As creators and company owners, we are motivated by the idea of a continent filled with millions of amazing companies that are prosperous, envious of, and beloved. In our lifetimes, we think African enterprises will consistently compete against the world’s top businesses and prevail. We have a purpose every day as we build that world.

Pros Of Paystack

- Paystack is a very good and reliable payment gateway that can be used to receive payment from websites.

- The dedicated NUBAN feature makes reconciliation seamless.

- It has been super easy using Paystack to collect payments.

Cons Of Paystack

- Paystack needs an internet connection to process payments, so it might not be feasible to take payments if there are problems with internet connectivity.

- There is no instant payout for your earnings.

- You cannot receive payment in dollars from all banks through Paystack.

- Some browsers have extensions that block the loading of scripts and it can lead to a frustrating search for bugs when customers report issues with payment.

- The fact that same-day settlement was not available or was only available at a premium was a downside to Paystack

3. Skrill

Skrill is an online payment platform that allows individuals and businesses to send and receive money globally. Formerly known as Moneybookers, Skrill offers a range of services including online payments, money transfers, and digital wallet functionality. It is widely used for e-commerce, online gambling, freelancing, and international money transfers.

One of the key features of Skrill is its digital wallet, which provides users with a secure and convenient way to store funds and make online payments. Users can link their bank accounts, credit cards, or other payment methods to their Skrill wallet and easily manage their transactions.

Skrill also enables users to send money to friends, family, or businesses around the world. With competitive currency exchange rates and low fees, Skrill offers a cost-effective solution for international money transfers.

Additionally, Skrill offers a prepaid Mastercard that users can use for online and offline purchases, as well as ATM withdrawals. The Skrill card provides flexibility and accessibility to funds stored in the user’s digital wallet.

Skrill strongly emphasises security, implementing measures such as two-factor authentication, encryption, and anti-fraud systems to protect user accounts and transactions.

Pros Of Skrill

- Global payment capabilities with a wide network of supported countries.

- Convenient digital wallet for secure online payments.

- Competitive currency exchange rates for international transfers.

- Prepaid Mastercard for easy access to funds.

Cons Of Skrill

- Global payment capabilities with a wide network of supported countries.

- Convenient digital wallet for secure online payments.

- Competitive currency exchange rates for international transfers.

- Prepaid Mastercard for easy access to funds.

4. Flutterwave

The next on our list of 10 best alternatives to Paypal for Nigerian Entrepreneurs in 2023 is Flutterwave

A popular payment platform called Flutterwave enables companies to take payments from a variety of sources making it easy for business owners to carry on business and receive payment easily. Across the continent, Flutterwave is a Nigerian fintech business that offers a payment infrastructure for international retailers and payment service providers.

Flutterwave is compatible with several payment options, including credit cards, bank transfers, and mobile money. As a flexible option for Nigerian business owners, Flutterwave also provides options like split payments and recurring billing in which you can preset payment for a particular service for a recurring period.

Pros Of Flutterwave

- It has a wide payment options,

- it has pan-African coverage,

- seamless integration,

- advanced security,

- developer-friendly tools.

Cons Of Flutterwave

- It has Limited international coverage,

- It has low transaction fees,

- customer support challenges,

- occasionally technical issues might arise

- It has regulatory complexities.

5. STripe

Stripe is a global payment processing company that provides businesses with the infrastructure to accept and manage online payments. It offers a comprehensive suite of tools, APIs, and services that enable businesses to seamlessly integrate Stripe’s payment functionality into their websites and applications.

Stripe supports a wide range of payment methods, including credit and debit cards, digital wallets, and local payment options specific to different countries. It handles the complexities of payment processing, including security, compliance, and data privacy, allowing businesses to focus on their core operations.

With Stripe, businesses can set up recurring billing, implement subscription-based models, and manage customer subscriptions with ease. It provides tools for managing disputes, handling refunds, and analyzing payment data to gain insights into business performance.

One of the key advantages of Stripe is its developer-friendly approach. It offers extensive documentation, software development kits (SDKs), and developer tools to simplify integration and customization. Developers can leverage Stripe’s APIs to create unique payment flows, tailor the checkout experience, and build robust e-commerce platforms.

Stripe has gained popularity for its user-friendly interface, seamless payment experience, and a strong emphasis on security and fraud prevention.

Pros Of Stripe

- Stripe is a Developer-friendly platform with robust APIs and documentation.

- Wide range of payment method support.

- Seamless integration and customization options.

- Strong emphasis on security and fraud prevention.

Cons Of Stripe

- Strict account and payout verification processes.

- Limited customer support for non-enterprise users.

- Inconsistent availability in some countries.

- Complexity for businesses with unique payment needs.

6. Interswitch WebPay

The next on our list of the 10 best alternatives to Paypal for Nigerian Entrepreneurs in 2023 is the Interswitch WebPay.

Interswitch WebPay is a reliable payment gateway in Nigeria that facilitates online transactions. It provides secure payment processing, supports multiple currencies, and integrates with popular e-commerce platforms.

Interswitch is one of Nigeria’s top payment processing companies and one of the 10 best alternatives to Paypal for Nigerian Entrepreneurs in 2023 that offers WebPay, a safe online payment gateway. Through a variety of platforms, such as websites and mobile applications, it lets businesses accept online payments from clients.

Businesses using WebPay can give their consumers a variety of payment alternatives, including debit and credit cards from well-known international payment processors like Visa, Mastercard, and Verve. The platform offers strong security measures, including fraud protection tools and encryption, to guarantee secure transactions.

Additionally, Interswitch WebPay provides extensive reporting and analytics tools, enabling organizations to monitor and examine their payment data for more insightful analysis and decision-making.

Interswitch is currently a critical mass leader in the rapidly evolving financial ecosystem in Africa. It is active throughout the payments value chain and offers a comprehensive range of omnichannel payment solutions. Nigerian entrepreneurs can leverage its extensive reach and robust infrastructure to streamline their payment processes.

Pros Of Interswitch WebPay

- Interswitch WebPay has a wide acceptance

- It has secure transactions

- multiple payment options,

- integration flexibility,

- It has comprehensive reporting and analytics making decision making easier.

Cons Of Interswitch WebPay

- Interswitch has Geographical limitations

- It has limited international reach

- It has technical integration complexity

- It has high transaction fees

- mixed customer support experiences.

7. Remitly

Remitly is a digital remittance service that enables individuals to send money internationally. It offers a convenient and secure platform for users to transfer funds across borders, providing a faster and more cost-effective alternative to traditional money transfer methods.

With Remitly, users can send money from their bank account, credit card, or through cash pick-up locations to recipients in various countries around the world. The service supports transfers to a wide range of destinations, including Asia, Africa, Europe, and Latin America.

Remitly focuses on providing competitive exchange rates and low fees for its users. This makes it an attractive option for individuals who frequently send money to their families or friends abroad or need to make business payments internationally.

The platform offers different delivery options, including bank deposits, cash pickups, and home delivery, depending on the recipient’s location. Users can track their transfers in real time through the Remitly app or website, providing transparency and peace of mind.

Remitly prioritizes the security of its users’ transactions. It utilizes encryption and other security measures to protect personal and financial information, ensuring that funds are transferred safely.

Pros Of Remitly

- Fast and convenient international money transfers.

- Competitive exchange rates and low fees.

- Multiple delivery options for recipients.

- Real-time tracking of transfers for transparency.

Cons Of Remitly

- Limited availability in certain countries.

- Bank transfers may take longer to deliver.

- Cash pick-up options may have limited locations.

- Additional services like bill payments and top-ups are available in select countries only.

8. BOSS Revolution

If you are sending money abroad, BOSS Revolution is a great choice. The company provides one of the most affordable and quick methods for sending money internationally from the US to Nigeria, despite the fact that it is not yet configured for local US transfers. Money recipients can obtain the wired amount in minutes thanks to the low-fee structure, which is available on their web platform and mobile app.

In addition to offering a free initial transaction, BOSS Revolution offers reduced charges than PayPal on subsequent transactions as well. Users in Nigeria have the option of choosing cash delivery or bank deposit options. Given that both the sender and receiver’s information is accurate and confirmed, sending money abroad is made more convenient by the system’s acceptance of debit and credit cards.

BOSS Revolution also enables users to recharge mobile phones instantly, both domestically and internationally. With support for over 150 countries, users can conveniently top up mobile credit for themselves or send mobile recharges as a gift to others.

In addition to communication services, BOSS Revolution offers money transfer solutions. Users can send money to over 50 countries worldwide, providing a convenient way to support family members or make business payments across borders. The platform ensures secure and reliable money transfers, allowing users to track their transactions and provide recipients with cash pickup or bank deposit options.

Overall, BOSS Revolution offers a comprehensive suite of services that cater to the communication and financial needs of individuals and businesses. It is international calling, mobile top-up, money transfer, and prepaid debit card solutions that provide convenience, affordability, and reliability for users around the world.

9. VoguePay

We also have VoguePay on our list of 10 best alternatives to Paypal for Nigerian Entrepreneurs in 2023.

VoguePay is a secure online payment gateway that enables both companies and private users to send, receive, and process payments. It is a worldwide fintech company with its headquarters in Nigeria. Through multiple channels, such as websites, mobile applications, and social media platforms, VoguePay enables businesses to take payments from clients in the form of debit and credit cards, bank transfers, and digital wallets are just a few of the many payment options it accepts.

The platform offers reliable security safeguards, fraud detection capabilities, and flexible alternatives for smooth integration.

VoguePay is a user-friendly online payment platform that offers local and international payment options. It allows Nigerian entrepreneurs to receive payments from customers worldwide, supports recurring payments, and provides detailed analytics to track transactions. VoguePay also offers a virtual POS terminal for offline payments.

In addition, VoguePay provides features like recurring payments, invoicing, and thorough transaction reporting, enabling businesses to efficiently manage their payment processes.

Pros Of VoguePay

- Wide payment method acceptance

- Multi-currency support

- Secure transactions

- Integration flexibility

- Comprehensive reporting and analytics.

Cons Of VoguePay

- Limited brand recognition compared to global competitors

- Limited international reach

- Transaction fees

- Customer support could be improved in some cases

- Complexity for non-technical users in setup and integration.

5. Remita

The next on our list of the 10 best alternatives to Paypal for Nigerian Entrepreneurs in 2023 is Remita. Remita is an online payment platform in Nigeria that facilitates seamless electronic transactions between individuals, businesses, and government agencies.

This payment platform allows users to make and receive payments, manage invoices, and automate payment processes, it also supports various payment methods and provides secure and efficient payment solutions. Remita is a comprehensive payment solution that was developed by SystemSpecs, a Nigerian software company.

ALSO, READ 10 Best Mobile Banking Apps Currently in Nigeria 2023

It supports multiple payment channels, including cards, bank transfers, and e-wallets, making it a versatile choice for Nigerian entrepreneurs.

Pros Of Remita

- It has a wide acceptance level

- multiple payment options

- It is very security

- It allows for payment automation

- Transaction tracking is very easy.

Cons Of Remita

- However, it has limited international reach

- It has a complex system integration

- the user interface could be improved

- It has transaction fees

- There are occasional challenges with customer support, it might take hours to get through to customer support.

6. Paga

Paga is next on our list of the 10 best alternatives to Paypal for Nigerian Entrepreneurs in 2023

Paga is a mobile payment platform based in Nigeria that provides individuals and businesses with convenient and secure financial services. It also allows users to send and receive money, make bill payments, purchase airtime, and conduct other financial transactions through their mobile devices.

Paga operates through its mobile app, USSD codes, and a network of agents across the country, making it well spread in Nigeria. Users of Paga can link their bank accounts, cards, or mobile wallets to their Paga accounts for seamless transactions.

Paga focuses on extending financial services to the unbanked and underbanked populations in Nigeria, offering them access to digital payments and financial inclusion.

It is a mobile payment platform that enables individuals and businesses to send and receive money securely. Nigerian entrepreneurs can leverage Paga’s services to facilitate transactions with their customers, pay bills, and perform other financial activities.

Paga’s user-friendly interface and widespread adoption make it a convenient choice for Nigerian Entrepreneurs in 2023.

Pros Of Paga

- Financial inclusion is available on Paga

- the convenience of operation is a plus to the platform

- It has a well-coordinated agent network

- It has a secure integration with banks and mobile wallets.

Cons Of Paga

- Limited international reach

- transaction fees are charged on every transaction

- Users experience occasional service outages

- dependency on mobile connectivity.

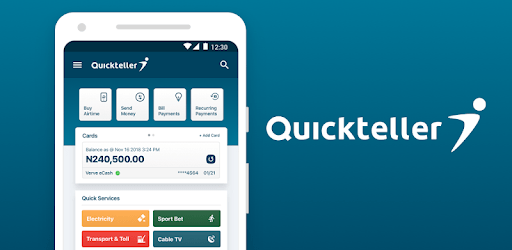

7. Quickteller

Quickteller is a popular Nigerian platform that provides a range of financial services, including payments, airtime recharge, and bill payments. Quickteller is next on our list of the 10 best alternatives to Paypal for Nigerian Entrepreneurs in 2023

It offers a wide range of services, including bill payments, airtime and data recharge, fund transfers, and online shopping.

Users can access Quickteller through its website, mobile app, or by visiting partner bank branches. It accepts payments through various channels, including cards, bank transfers, and digital wallets.

It equally provides a secure and convenient way for users to manage their financial transactions and access essential services. It allows Nigerian entrepreneurs to accept payments from customers through multiple channels, such as cards, bank transfers, and USSD codes.

Quickteller’s extensive service offerings make it a versatile and trusted platform in Nigeria, making it a popular choice for online payments and financial transactions in Nigeria.

Pros Of Quickteller

- Quickteller offers a range of payment services in one platform, providing convenience for users.

- It is widely accepted across Nigeria, making it easy to access and use.

- Quickteller supports various payment methods, including cards, bank transfers, and digital wallets.

- It is a trusted and recognized brand in Nigeria, instilling confidence in users.

- Quickteller provides a diverse range of services, including bill payments, airtime recharge, and online shopping.

Cons of Quickteller

- Quickteller’s services are primarily focused on Nigeria, limiting its availability for international transactions.

- Quickteller charges fees for certain transactions, which can impact the overall cost for users.

- Some users have reported mixed experiences with Quickteller’s customer support, citing delays or difficulties in resolving issues.

- The user interface of Quickteller could be more intuitive and user-friendly, according to some users.

- Integrating Quickteller into existing systems may require technical expertise, posing a challenge for businesses without dedicated IT resources.

8. eTranzact

The next on our list of the 10 best alternatives to Paypal for Nigerian Entrepreneurs in 2023 is eTranzact. eTranzact is a leading payment solutions provider in Nigeria, offering secure and reliable payment processing services.

eTranzact is a Nigerian electronic payment platform that provides secure and convenient financial services to individuals, businesses, and government organizations.

It offers a wide range of services, including online payments, funds transfers, bill payments, mobile banking, and card solutions. This payment platform operates through various channels, such as its website, mobile app, and point-of-sale (POS) terminals.

It also enables users to perform transactions using different payment methods, including cards, bank accounts, and mobile wallets. Due to its strong focus on security and reliability, eTranzact ensures safe and seamless transactions for its users. It has become a trusted and widely used platform in Nigeria’s digital payments ecosystem.

eTranzact also supports various payment options, including cards, bank transfers, and mobile wallets. eTranzact’s robust infrastructure and integration capabilities make it an attractive choice for Nigerian entrepreneurs.

Pros Of eTranzact

- It offers a wide range of financial services

- It has a secure and reliable platform

- eTranzact offers multiple payment methods

- Convenient access through the website, app, and POS terminals

Cons Of eTranzact

- It has very limited international reach

- Transaction fees may apply

- Customer support quality can vary

- Technical issues or service disruptions reported by some users

9. Opay

The next on our list of the 10 best alternatives to Paypal for Nigerian Entrepreneurs in 2023 is Opay. Opay is a mobile payment platform that originated in Nigeria and has since expanded its services to other countries in Africa and Asia.

It offers a comprehensive range of financial services and solutions designed to simplify and enhance the way people make transactions and manage their finances.

Through the Opay mobile app, users can access a variety of services, including mobile money transfers, bill payments, merchant payments, ride-hailing services, food delivery, and more. The platform operates as a digital wallet, allowing users to store funds securely and make payments conveniently using their mobile devices.

As one of the 10 best alternatives to Paypal for Nigerian Entrepreneurs in 2023, Opay aims to promote financial inclusion by targeting the unbanked and underbanked populations in emerging markets.

Opay provides easy access to digital financial services, Opay enables individuals who previously lacked access to traditional banking services to participate in the digital economy.

One of the key features of Opay is its extensive agent network. Users can deposit or withdraw cash through Opay agents, who are present in various locations, making it convenient for users to convert their digital funds into physical currency or vice versa.

Opay is also known for its emphasis on user experience, affordability, and efficiency. The platform strives to provide a seamless and user-friendly interface for performing transactions and managing finances. It aims to make financial services accessible to all by offering competitive transaction fees and a wide range of services.

Opay’s expansion into multiple countries demonstrates its commitment to serving the needs of different markets and populations. With its growing presence and comprehensive offerings, Opay continues to establish itself as a leading mobile payment platform in the regions it operates.

Opay also offers a user-friendly interface and supports multiple payment options. Opay’s popularity and widespread acceptance in Nigeria make it a viable alternative to PayPal.

Pros Of OPay

- Wide range of financial services and solutions.

- Emphasis on user experience and convenience.

- Extensive agent network for cash deposits and withdrawals.

- Affordable transaction fees.

- Focus on financial inclusion for the unbanked and underbanked populations.

Cons Of OPay

- It has limited availability in certain regions.

- Its Potential challenge is with agent availability in some areas.

- Reliance on mobile network connectivity for transactions.

- Limited integration options with external platforms.

- Customer support quality can vary.

10. CashEnvoy

CashEnvoy is an online payment platform based in Nigeria that provides individuals and businesses with secure and convenient electronic payment solutions. It allows users to send and receive money, make online purchases, pay bills, and perform other financial transactions over the Internet.

CashEnvoy operates as a digital wallet, where users can store funds securely and link their bank accounts or cards to facilitate transactions. It supports various payment methods, including bank transfers, card payments, and mobile wallets, providing users with flexibility in choosing their preferred payment option.

One of the key features of CashEnvoy is its focus on security. The platform employs robust security measures, including encryption and fraud prevention mechanisms, to ensure the safety of user transactions and personal information.

CashEnvoy is widely accepted by numerous merchants and online platforms in Nigeria, making it convenient for users to make online purchases and payments across a wide range of services.

In addition to individual users, CashEnvoy also caters to the needs of businesses. It offers merchant services, allowing businesses to integrate CashEnvoy into their websites or mobile applications, enabling them to accept online payments from customers.

CashEnvoy provides comprehensive reporting and analytics tools, allowing users to track and analyze their payment transactions, monitor sales performance, and gain insights into their financial activities.

CashEnvoy is a Nigerian online payment platform that enables businesses to accept payments from customers securely.

While CashEnvoy primarily operates within Nigeria, it aims to expand its services to other African countries, contributing to the growth of digital payments and financial inclusion in the region.

The platform also supports various payment methods, including cards, bank transfers, and mobile money. CashEnvoy offers features like recurring billing, customizable payment pages, and detailed transaction reports.

Pros Of CashEnvoy

- Secure and convenient online payment platform.

- Wide acceptance by numerous merchants in Nigeria.

- Supports various payment methods for user flexibility.

- Robust security measures to protect transactions and personal information.

- Comprehensive reporting and analytics tools for users and businesses.

Cons Of CashEnvoy

- Limited availability outside Nigeria.

- Potential challenges with customer support.

- May require technical integration for businesses.

- Transaction fees may apply.

- Limited adoption compared to some other payment platforms in the market.

Conclusion

While PayPal has been a popular choice for Nigerian entrepreneurs, exploring alternative payment platforms can provide greater convenience, flexibility, and customization options.

All the payment platforms listed have their unique features and strengths, and the “best” one depends on individual preferences, specific business requirements, and regional context.

Choosing the best payment platform depends on individual needs and preferences because each platform has its strengths and target markets.

What Is The Best Alternative To Paypal?

However, Stripe has gained significant popularity among Nigerian businesses and entrepreneurs for its robust payment processing capabilities, developer-friendly platform, and seamless integration options. Stripe is widely used by Nigerian startups, e-commerce businesses, and online service providers due to its ease of use, security features, and competitive rates.

Nonetheless, it is recommended to thoroughly evaluate each platform’s features, fees, and suitability for your specific business requirements before making a decision. To determine the best payment platform for your specific needs, consider factors such as geographical coverage, supported payment methods, security, integration requirements, transaction fees, customer support, and the specific features that align with your business goals.

All being said, both Paystack and Flutterwave are highly regarded and widely used payment platforms in Nigeria and Africa in general. They offer robust features, developer-friendly APIs, and support for various payment methods.